Progressive life faces Tk 114 crore life fund embezzlement allegation, no recovery in 13 years

Raj Kiron Das: A long-running controversy involving Progressive Life Insurance Company Limited has reignited public concern after new details emerged from audit documents and regulatory correspondence indicating that Tk 114.22 crore may have been siphoned from the company’s life fund- the policyholders’ trust fund- between 2009 and 2012, although no money has supposedly been recovered for more than a decade.

At the center of the allegations is a series of transactions described as irregular, including a highly disputed land purchase in Aftabnagar, Dhaka, where auditors concluded the insurer paid substantially above market value- an overpayment the audit characterised as a mechanism for diverting funds. The case has raised questions regarding regulatory enforcement, board’s accountability and whether policyholders’ money has remained vulnerable due to governance structure in which alleged decision-makers continued to hold influence.

This report is based on the information contained in the investigative material provided, including management audit findings, letters exchanged between oversight bodies and description of subsequent action taken by investigators and regulators.

Why it matters: Policyholder funds, not corporate cash

In life insurance, the life fund is effectively the financial backbone that supports claims, maturity benefits and policy obligations. Allegations that money was diverted from this fund elevate the issue beyond corporate mismanagement: they strike at the integrity of a system meant to safeguard many of policyholders.

The investigative material claims that despite several inquiries and instruction from regulators, policyholders have seen no recovery of the allegedly misappropriated funds over 13 years, even as customers reportedly struggle to receive payments amid a fund crunch.

The Aftabnagar land deal: Alleged overpricing and conflict-of-interest concern

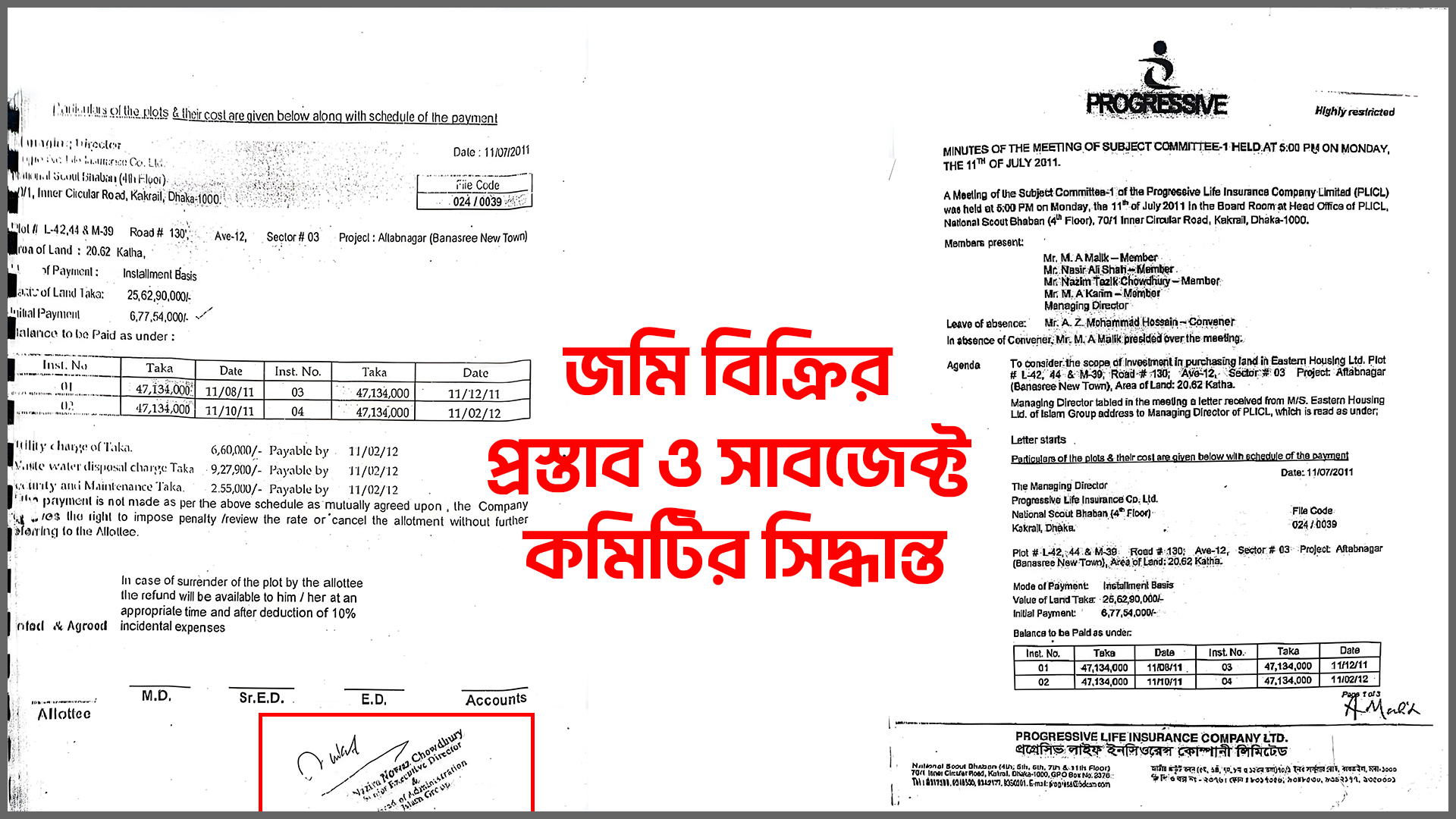

A major portion of the alleged misappropriation is linked to the purchase of three plots totaling 20.62 kathas in Dhaka’s Aftabnagar in 2011.

According to the documents summarised in the investigation:

- Progressive Life purchased the land for Tk 25.63 crore, or unevenly Tk 1.25 crore per katha.

- The report contrasts that figure with another insurer’s later purchase in the same area: Green Delta Insurance allegedly bought 10 kathas in 2014 at Tk 55 lakh per katha and in 2021 considered a sale price of Tk 65 lakh per katha.

- Based on this comparison, the investigation argues Progressive Life paid around Tk 70 lakh more per katha, despite buying earlier- implying an estimated excess payment in the range of Tk 14.22 crore.

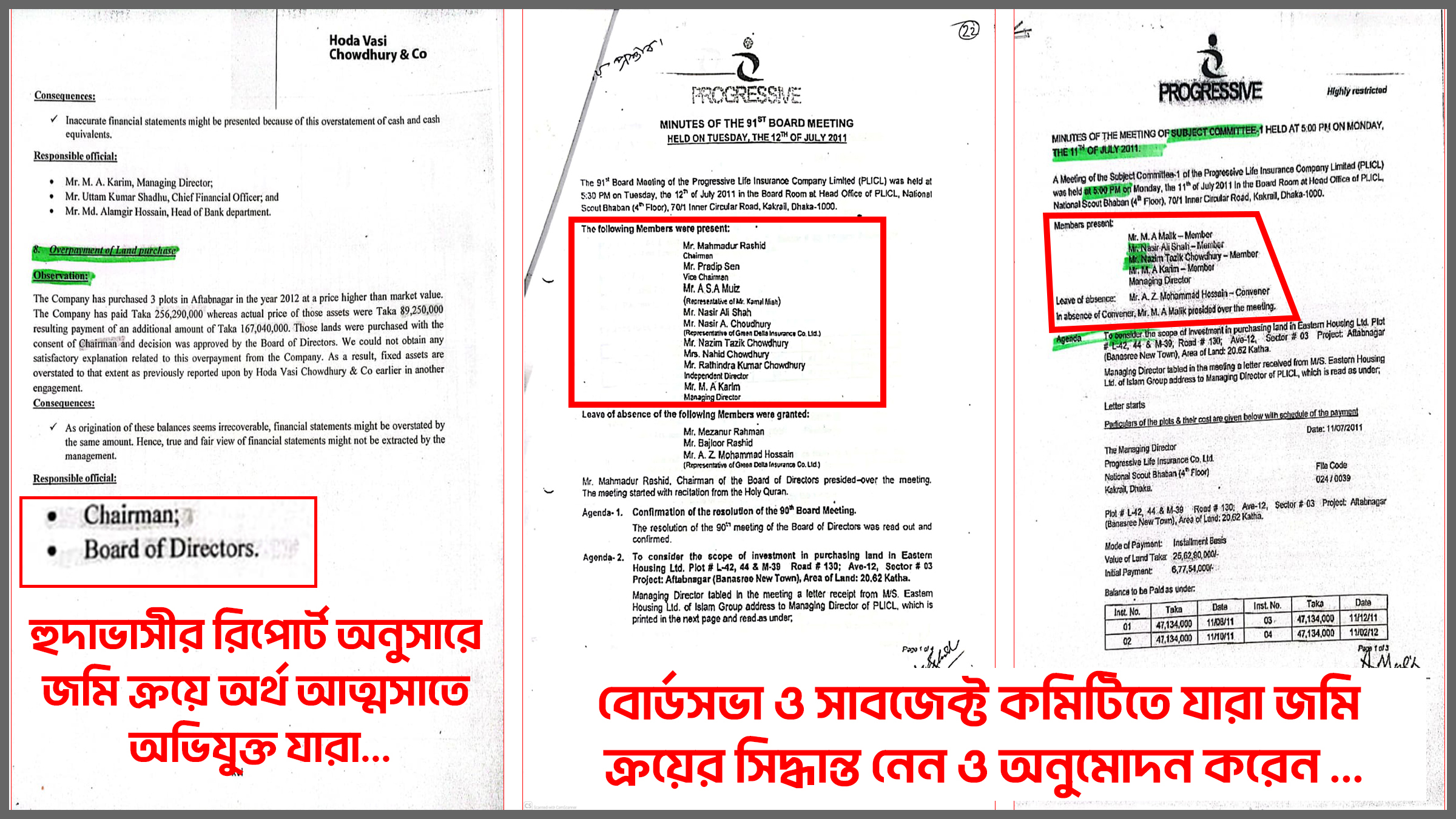

Payment allegedly made before board approval

The documents also raise process concern. The land purchase was approved at Progressive Life’s 91st board meeting on July 12, 2011, but the investigation claims Tk 3 crore was paid before the meeting began, suggesting that key financial commitments were executed prior to formal board authorisation.

Committee decision-making and personal ties

The investigation further describes a decision chain where a land sale proposal was reportedly made to the insurer on July 11, 2011 and the company’s internal committee decided the same day. It alleges that the committee and board meetings included participants with close family relationships, raising concern regarding whether independent oversight was compromised.

Deed value discrepancies and unresolved ownership

Beyond pricing, the documents highlight additional red flags:

- Although the insurer allegedly paid the full amount in 2011, it reportedly still has not obtained ownership of 7.08 kathas.

- Two deed registrations in 2017 reportedly declared values far below the purchase price-showing a combined value of Tk 72.60 lakh for two plots- prompting concern regarding whether the transaction documentation understated land values.

If accurate, these issues reflect both financial exposure and legal vulnerability: paying in full without receiving full title and discrepancies between payments and declared deed values, may produce long-term losses and obstruct recovery.

The 2014 management audit: Tk 114.22 crore in alleged irregularities

The investigative material says Progressive Life’s board decided to conduct a management audit at its 120th board meeting on January 23, 2014, appointing the audit firm Hoda Vasi Chowdhury & Co. to examine the period 2009-2012.

The auditors reportedly submitted their report on July 15, 2014, concluding that Tk 114.22 crore was misappropriated or lost through fraud, irregularities and governance failures, holding the chairman, directors, managing director and senior officials responsible.

Aftabnagar: Alleged Tk 16.70 crore diversion

The audit reportedly estimated the ‘actual’ value of the Aftabnagar land at Tk 8.92 crore, compared to the Tk 25.62 crore paid- implying Tk 16.70 crore was siphoned through inflated pricing.

Chattogram acquisition: Disputed property and escalating losses

The audit also referenced a disputed purchase in Agrabad, Chattogram, where the insurer bought 9,500 square feet of floor space in 2011 for Tk 2.92 crore, but allegedly could not take possession due to ownership dispute. The investigation says legal and related expenses increased losses to Tk 3.47 crore.

Additional alleged channels of misuse

The documents describe other categories of irregularities, including claims of:

- Inflated commissions based on allegedly false premium-income figures,

- Premium collections supposedly not deposited into the fund,

- Cash withdrawals and misreporting across various accounts,

- Duplicate premium receipts,

- Unauthorised payments and benefits beyond approved compensation.

Enforcement gap: What happened after the findings?

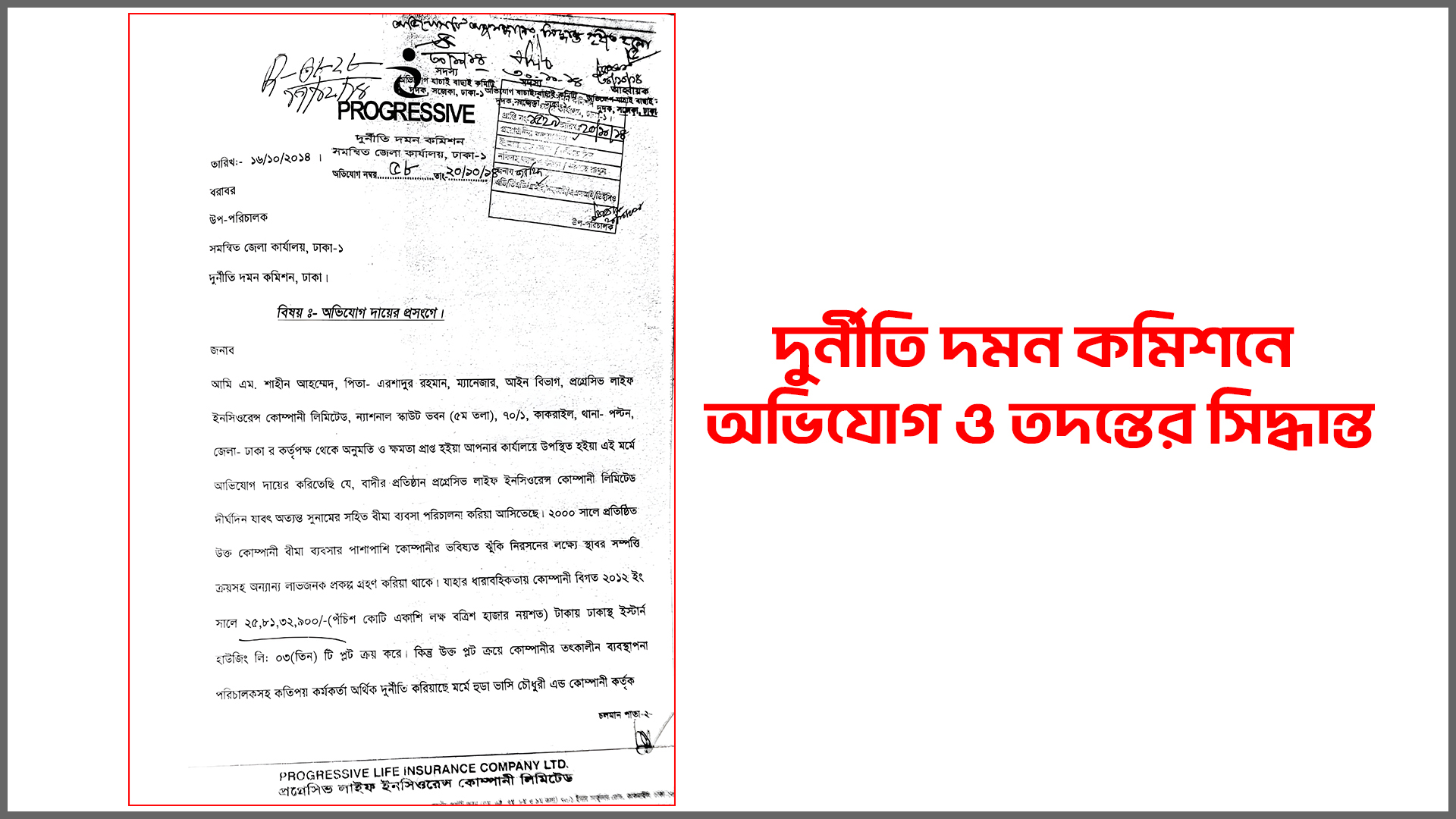

ACC probe closed after jurisdiction issue, documents say

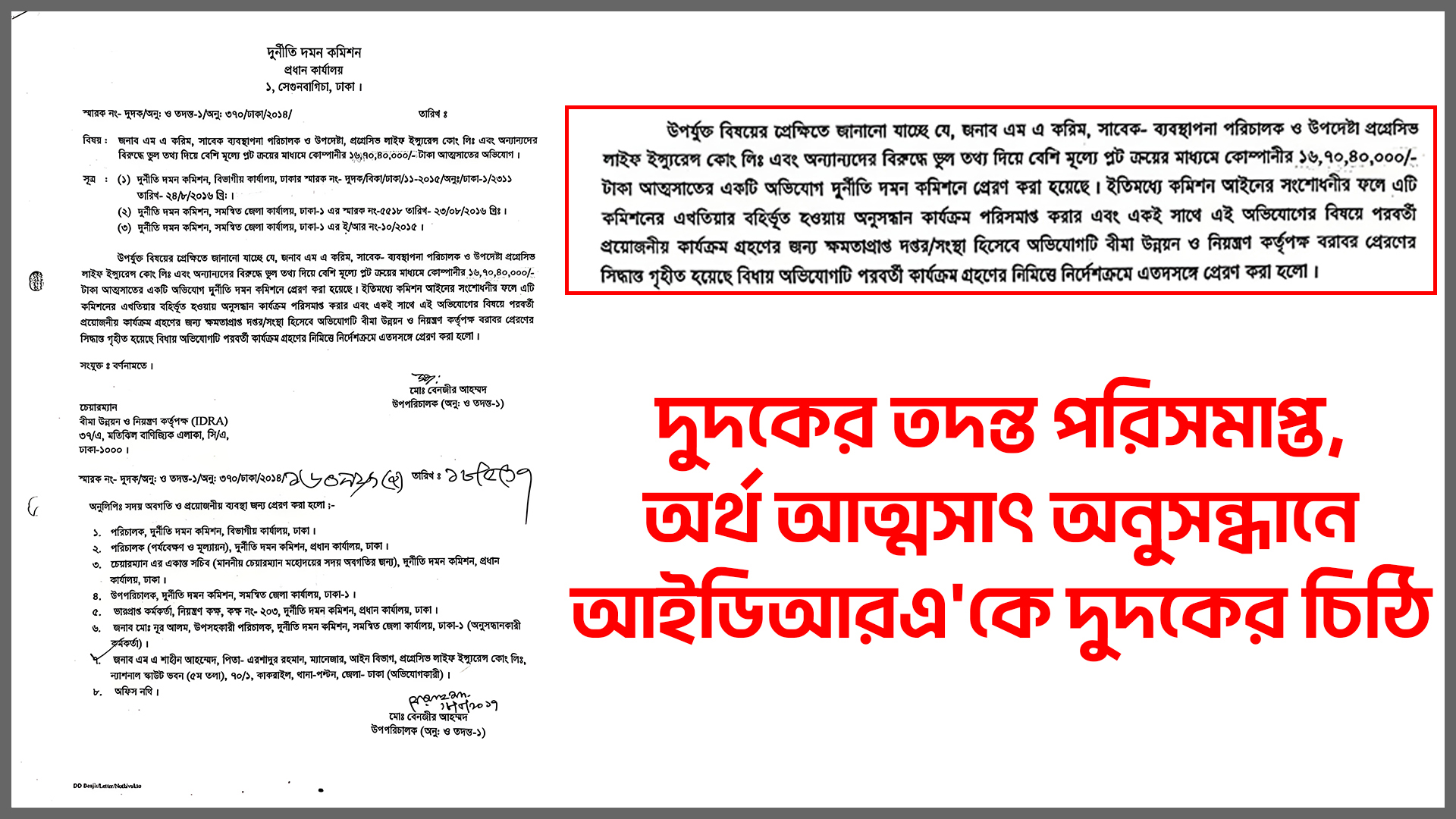

According to the investigation, Progressive Life made a complaint to the Anti-Corruption Commission (ACC) in October 2014. The ACC later reportedly concluded it could not proceed after a legal amendment changed its jurisdiction and it asked the insurance regulator, IDRA, to take necessary steps.

IDRA reportedly found evidence but did not remove figures

The investigation says that the IDRA formed an inquiry committee and identified numerous irregularities, including evidence consistent with the management audit’s findings. However, it argues that despite provisions in the Insurance Act 2010 allowing the regulator to remove responsible persons and appoint an administrator to pursue recovery, IDRA did not take those stronger measures.

Instead, the documents say, IDRA instructed the company itself to file cases- an approach the investigation reveals as structurally flawed if alleged decision-makers still held influence in the board.

BSEC inquiry also described as inconclusive

The investigation claims the Bangladesh Securities and Exchange Commission (BSEC) initiated an inquiry through a committee, but no meaningful outcome was recorded in the materials cited.

Cases filed- but the legal route is contested

According to the investigation, the Insurance Act provides for recovery steps through higher-court processes, yet the case pathways taken were inconsistent:

- A CR case in Dhaka CMM court (2025) linked to alleged misappropriation in the Aftabnagar purchase,

- Another case filed at Paltan Model Police Station under several Penal Code sections and a separate CR case filed in 2018 related to premium-collections allegation.

It also asserts that some individuals allegedly identified in earlier processes were not named in later case filings, raising questions regarding whether accountability was applied consistently.

CID investigation: allegations ‘substantiated,’ documents claim

One of the most consequential developments cited is a CID investigation report submitted to a Dhaka magistrate court on November 9, 2025. According to the investigative summary provided:

- The CID considered the allegations regarding the Aftabnagar purchase to be substantiated,

- Concluding that responsible purchase representatives allegedly failed to verify ownership properly and did not establish competitive price determination and that the process enabled payment of Tk 16.70 crore beyond market value through an allegedly flawed and collusive purchase mechanism.

What officials and the company say

The documents cite IDRA’s media and communications consultant and spokesperson Saifunnahar Sumi as saying that limitations in the Insurance Act 2010 have constrained the regulator’s capability to act in such cases and that efforts are underway to amend the law to strengthen enforcement capacity.

The investigation also references comments attributed to Progressive Life’s current chairman Bazlur Rashid, MBE, who says that the company’s capability to pursue legal action has been obstructed over time by internal governance dynamics. He reportedly underscores that he was not chairman during the alleged period of wrongdoing and suggests that influential figures connected to the allegation have remained powerful in the board, discouraging or blocking litigation. He also says that at least one recent case was initiated by a shareholder rather than directly by the company.

The unresolved core issue: policyholders’ money and answerability

The most serious claim running through the investigation is not simply that irregularities occurred- but that the system failed to correct them:

- A management audit reportedly documented large-scale losses from a policyholder fund.

- Several oversight bodies reportedly reviewed the matter.

- Investigators later described key allegations as substantiated.

- Yet the documents claim no recovery has been achieved over a 13-year period.

For policyholders, the implications are direct: delayed or unpaid claims, uncertainty regarding fund health and diminished trust in a system designed to safeguard long-term savings.

For regulators and the industry, the case raises a broader question: If an insurer’s life fund may allegedly be depleted through disputed transactions and recovery remains stalled for over a decade, what safeguards are strong enough to prevent repetition?

Until that question is answered through clear enforcement outcomes- removal of responsible parties where warranted, transparent recovery steps and measurable restitution- Progressive Life’s controversy is likely to remain an emblem of the governance and regulatory challenges facing the sector.